Wellness and healthy living are the new growth drivers of the Private Label sector

Wellness and healthy living are the new growth drivers of the Private Label sector

Growth of the Private Label sector in Italy is largely attributable to organic products and to premium lines in general. Italian consumers are increasingly attentive to the impact of nutrition on their health. This is confirmed by the study conducted by Nielsen entitled “Global Health and Ingredient-Sentiment”, which focuses on the dietary habits and experiences of consumers in more than 60 countries worldwide with regard to certain foods and ingredients.

In recent years we have observed a change in the behaviour of global consumers, who increasingly see food as a source of well-being and take a more selective approach to nutrition, including an interest in health food products.

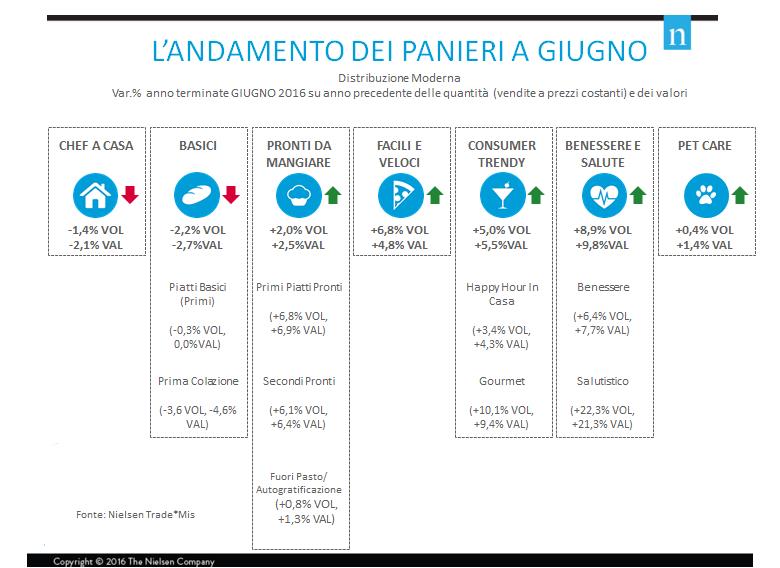

Italy is likewise seeing a new approach to food characterised by steady growth in consumption of products in the “Health & Wellness” sector. Over the last year, sales of these products have grown by 8.9% in volume (quantities sold at constant prices) and by 9.8% in value (Figure 8).

Figure 8 – Trends in Nielsen product categories

Source: Nielsen Trade*MIS, % annual variations of the category to June 2016 in modern distribution

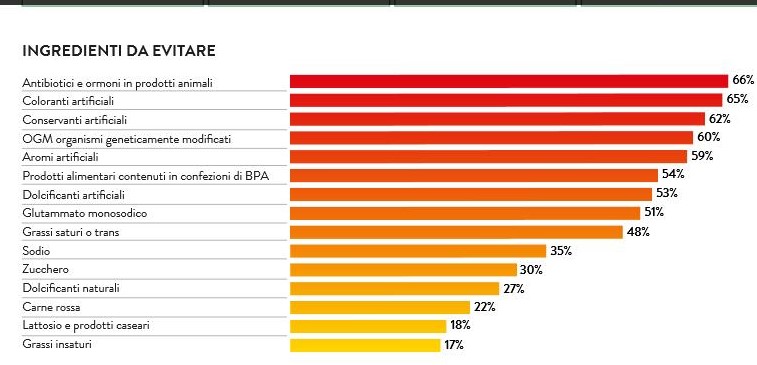

The health food phenomenon that has emerged in recent years is not limited to specific dietary or disease-related requirements. The study conducted by Nielsen (Figure 9) has shown that more than half of all Italians intentionally avoid consuming certain ingredients in their food. These include antibiotics and hormones in animal products (66%), artificial colouring (65%), artificial preservatives (62%), GM products (60%) and artificial flavours (59%).

Figure 9 – Attitude of Italians towards food products (% of people declaring they want to avoid the listed ingredients)

Source: Nielsen, “Global Health and Ingredient-Sentiment” survey

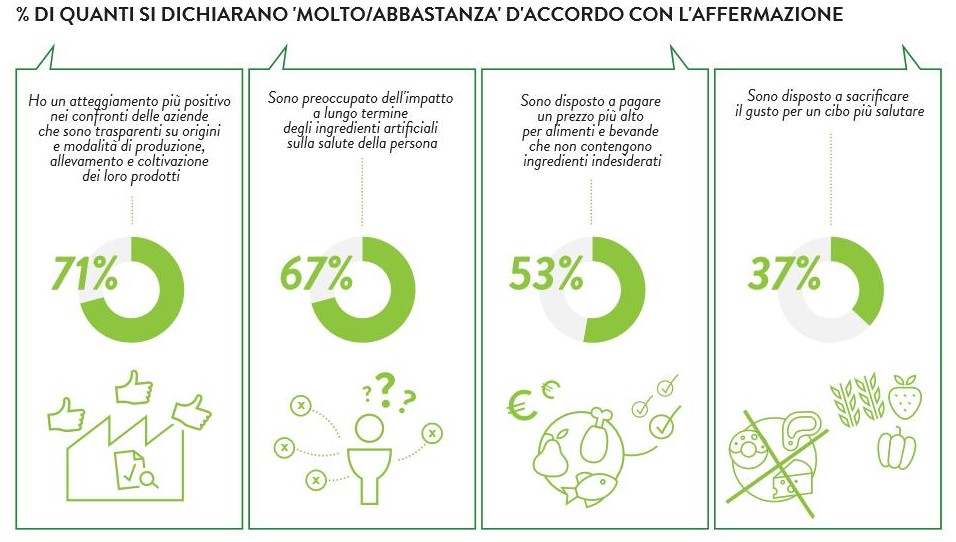

This suggests greater attention to the individual ingredients present in purchased foods, with 71% of Italians preferring manufacturers or distributors who embrace transparency with regard to origin and methods of production (Figure 10).

Figure 10 – Attitude of Italians towards food and food producers

Source: Nielsen, “Global Health and Ingredient-Sentiment” survey

The industry and distribution network must take these trends into account, especially when defining their commercial offerings and store assortments.

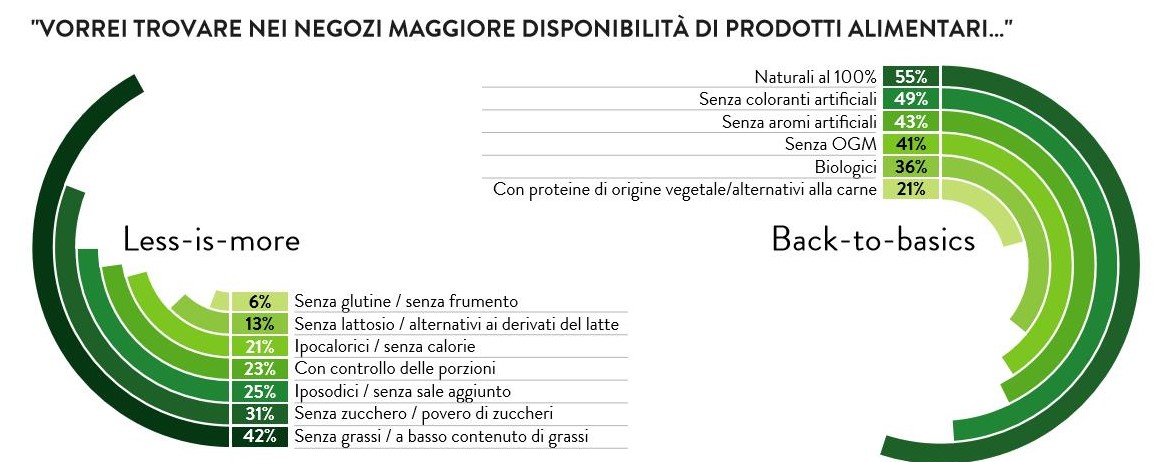

Here too, the consumers interviewed by Nielsen expressed very clear opinions (Figure 11). Firstly, they are looking for simple and minimally processed products whose characteristics are summed up in the survey by the expression “Back to Basics”: 100% natural products (55%), free of artificial colours (49%) and artificial flavours (43%), GM free (41%), organic (36%) and consisting of plant proteins (21% vs. 15% EU average).

Figure 11 – Attitude of Italians towards commercial assortments

Source: Nielsen, “Global Health and Ingredient-Sentiment” survey

Secondly, they are in search of products free of ingredients that may be harmful to their health. “Less is more” is the real value sought by consumers today, in other words low-fat foods (42% vs. 34% EU average), sugar free (31%), low-salt (25%), low-calorie (21%), but also with controlled portions (23%).